New Full-Service Lease in Partnership with Rush Truck Centers

We are proud to announce a new and exciting full-service step van lease program in partnership with Rush Truck Centers with all preventative maintenance performed right at the package and delivery contractor’s terminal. With this full maintenance lease, independent delivery…

New Podcast: Routing for Success

We are excited to announce the launch of our new podcast, Routing for Success! Aimed at package and delivery contractors, this podcast will feature interviews with industry experts and successful contractors, as well as practical tips and advice on how…

AP Equipment Financing Hires Zack Marsh as SVP of Accounting

BEND, OR. – AP Equipment Financing has hired Zack Marsh, CLFP, as the Senior Vice President of Accounting and Analysis. In this role, Zack will be responsible for managing the accounting and treasury operations of the organization including financial analysis,…

AP Equipment Financing Announces Record Funding Volume in 2022

Bend, OR – AP Equipment Financing is pleased to announce that the company funded a record $327 million in 2022, representing a 38% year-over-year growth. This achievement is a result of the company’s continued focus on its strategic plan to…

AP Equipment Financing Achieves 46% Q3 Growth & Wins Top Workplaces Award

AP Equipment Financing was awarded “The Oregonian: 2022 Regional Top Workplace Award” and funded a record-breaking $92.5 Million in Q3 2022, a 46% year-over-year increase from Q3 2021. “Over the past year, we have made strategic changes to our sales…

AP Equipment Financing Adds Mike Bransdorf to Lead Floorplan Inventory Division

BEND, OR. – AP Equipment Financing expands its current product offerings to include a wholesale flooring finance product for vendor and manufacturer partners and hires Mike Bransdorf to lead the program. “I am extremely excited to join the team at…

AP Equipment Financing Introduces CLFP Prep Program for Employees and Adds 10 New CLFP’s

BEND, OR. – In January 2022, AP Equipment Financing introduced a CLFP Prep Program to both AP and Tokyo Century USA employees with the purpose to prepare and teach the CLFP exam content to those interested in getting their CLFP…

AP Equipment Financing Achieves 68% Funding Volume Growth in Q2

BEND, OR. – AP Equipment Financing funded $78.8 Million in Q2 2022, a 68% year-over-year increase from Q2 2021. In the month of June alone, AP posted a funding volume of $29.1 million. With continued momentum, AP is projecting another…

AP Equipment Financing Posts Record Q1, 50% in YoY Funding Volume

BEND, OR. – AP Equipment Financing funded a record $63.5 million in Q1, a 50% year-over-year growth increase from Q1 2021. AP funded 906 transactions in Q1 2022, with an average transaction size of $70,040. “Our continued focus on providing…

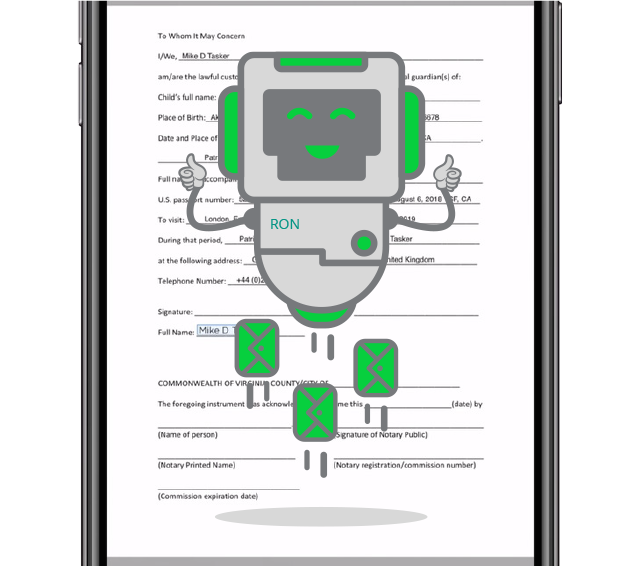

AP Equipment Financing Transitions to Remote Online Notarization Process

BEND, OR. – AP Equipment Financing recently made the switch to use a Remote Online Notarization (RON) for Power of Attorney and Bills of Sale documents during their customers’ transaction journey. This change to a RON will speed up the…

Helping Arborists Protect the Environment

An important industry sector of AP Equipment Financing is the arbor space. AP finances chippers, chip and bucket trucks, tracked lifts, and more for arborists throughout the US. This equipment provides essential tree care professionals with the ability to do…

AP Promotes Environmentalism through CalCAP and Tree Care Industry

How does CalCAP help AP to promote environmentalism? CalCAP, or California Capital Access Program, is designed to help small businesses in California by supporting loans to assist them in growing or maintaining their businesses. AP Equipment Financing is an approved…